A gestão de negócios é uma atividade essencial para o sucesso de uma empresa. É responsável por planejar, organizar, dirigir e controlar todos os aspectos do negócio, desde a produção até a comercialização dos produtos ou serviços oferecidos.

Além disso, a gestão de negócios também envolve a tomada de decisões estratégicas, a gestão de recursos humanos e financeiros e a análise constante do desempenho da empresa. Neste artigo, vamos explorar a função da gestão de negócios e como ela pode ajudar as empresas a alcançarem seus objetivos e se manterem competitivas no mercado.

O papel do gestor empresarial

O gestor empresarial é responsável por liderar e coordenar todas as atividades relacionadas ao funcionamento de uma empresa. Ele é o responsável por tomar decisões estratégicas, gerenciar recursos, planejar e implementar estratégias de crescimento e desenvolvimento da organização.

Além disso, o gestor empresarial também é responsável por:

- Definir metas e objetivos para a empresa;

- Estabelecer políticas e diretrizes para o funcionamento da empresa;

- Gerenciar equipes e liderar colaboradores;

- Monitorar e analisar resultados e indicadores de desempenho;

- Identificar oportunidades de mercado e novas tendências;

- Tomar decisões baseadas em dados e informações relevantes;

- Gerenciar riscos e tomar medidas preventivas;

- Estabelecer parcerias e alianças estratégicas;

- Garantir a qualidade dos produtos e serviços oferecidos pela empresa;

- Gerenciar a comunicação e o relacionamento com clientes, fornecedores e stakeholders.

Ele é responsável por liderar e coordenar todas as atividades necessárias para alcançar os objetivos e metas estabelecidos, além de garantir a eficiência e eficácia de todos os processos e operações da organização.

Funções essenciais da gestão.

A gestão de negócios é responsável por diversas funções que são essenciais para o sucesso de uma empresa. Entre as principais funções da gestão, podemos destacar:

- Planejamento: a gestão é responsável por definir as metas e objetivos da empresa, além de elaborar um plano de ação para alcançá-los. Isso envolve identificar oportunidades de mercado, definir estratégias de marketing, definir orçamentos e recursos necessários, entre outras tarefas.

- Organização: a gestão deve organizar todos os recursos da empresa, incluindo pessoas, equipamentos, tecnologia e materiais. Isso envolve definir as responsabilidades de cada colaborador, criar fluxos de trabalho eficientes, definir processos e procedimentos, entre outras ações.

- Liderança: a gestão deve liderar a equipe de colaboradores, motivando-os e inspirando-os a alcançar as metas e objetivos da empresa. Isso envolve desenvolver habilidades de comunicação, ser um exemplo para os demais colaboradores, tomar decisões difíceis, entre outras ações.

- Controle: a gestão deve monitorar o desempenho da empresa e dos colaboradores, verificando se as metas e objetivos estão sendo alcançados. Isso envolve analisar relatórios financeiros, acompanhar o desempenho de vendas, monitorar o atendimento ao cliente, entre outras tarefas.

Essas são apenas algumas das funções essenciais da gestão de negócios. É importante lembrar que a gestão deve ser realizada de forma integrada e estratégica, levando em conta todos os aspectos da empresa e os objetivos a serem alcançados.

Gestão eficiente de negócios.

A gestão eficiente de negócios é fundamental para o sucesso de uma empresa. Isso envolve uma série de estratégias e técnicas que visam maximizar os lucros, reduzir custos, aumentar a produtividade e garantir a satisfação dos clientes e dos colaboradores.

Para uma gestão eficiente, é importante ter um planejamento estratégico bem definido, com metas e objetivos claros, que orientem as ações da empresa. Além disso, é fundamental contar com uma equipe qualificada e motivada, que esteja alinhada com os valores e objetivos da empresa.

A gestão eficiente também passa pela análise constante dos resultados e pela tomada de decisões baseadas em dados e informações precisas. Isso envolve a utilização de ferramentas de gestão, como indicadores de desempenho, análise SWOT, entre outras.

Outro aspecto importante da gestão eficiente é a gestão financeira, que envolve o controle das finanças da empresa, a análise dos resultados financeiros e a projeção de cenários futuros.

Ela envolve uma série de estratégias e técnicas que visam maximizar os resultados, reduzir custos, aumentar a produtividade e garantir a satisfação dos clientes e dos colaboradores.

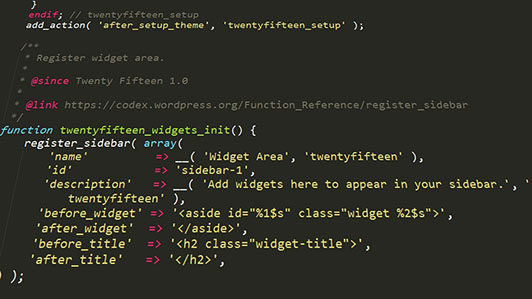

O que é PHP e qual a funcionalidade?

Conheça 6 exemplos de projetos sociais que transformam vidas

Tipos de gestão empresarial.

Existem diversos tipos de gestão empresarial que podem ser aplicados em uma organização, dependendo de seus objetivos e necessidades. Alguns dos tipos mais comuns são:

Gestão estratégica

A gestão estratégica tem como objetivo definir os objetivos e metas da empresa a longo prazo, bem como as estratégias que serão utilizadas para alcançá-los. É uma gestão voltada para a visão de futuro da organização.

Gestão financeira

A gestão financeira é responsável por cuidar das finanças da empresa, controlando receitas, despesas e investimentos, visando garantir a sustentabilidade financeira da organização.

Gestão de recursos humanos

A gestão de recursos humanos é responsável por gerir os colaboradores da empresa, desde o processo de recrutamento e seleção até o desenvolvimento e treinamento dos funcionários. É uma gestão voltada para o capital humano da organização.

Gestão de projetos

A gestão de projetos é responsável por planejar, executar e controlar projetos específicos da empresa, garantindo que sejam entregues dentro do prazo e orçamento estabelecidos.

Gestão de qualidade

A gestão de qualidade é responsável por garantir que os processos da empresa sejam realizados de forma eficiente e com qualidade, buscando a satisfação dos clientes e a melhoria contínua dos processos.

Conclusão

A gestão de negócios é fundamental para o sucesso de qualquer empreendimento. É por meio dela que se planeja, organiza, direciona e controla todas as atividades da empresa, visando sempre alcançar os objetivos e metas propostos. Portanto, investir em uma gestão eficiente é essencial para o crescimento e a prosperidade dos negócios.

A gestão de negócios é fundamental para garantir a sobrevivência e o sucesso de uma empresa. Ela envolve o planejamento estratégico, a tomada de decisões, a gestão de recursos financeiros, humanos e materiais, além do monitoramento e avaliação dos resultados alcançados.

Uma boa gestão de negócios permite identificar oportunidades de crescimento, gerenciar riscos, aumentar a eficiência e produtividade da empresa, além de manter uma relação saudável com os colaboradores, clientes e fornecedores. Em resumo, a gestão de negócios é a base para uma empresa bem-sucedida e sustentável a longo prazo.